Tax Deferral

Taxes on Retirement Income

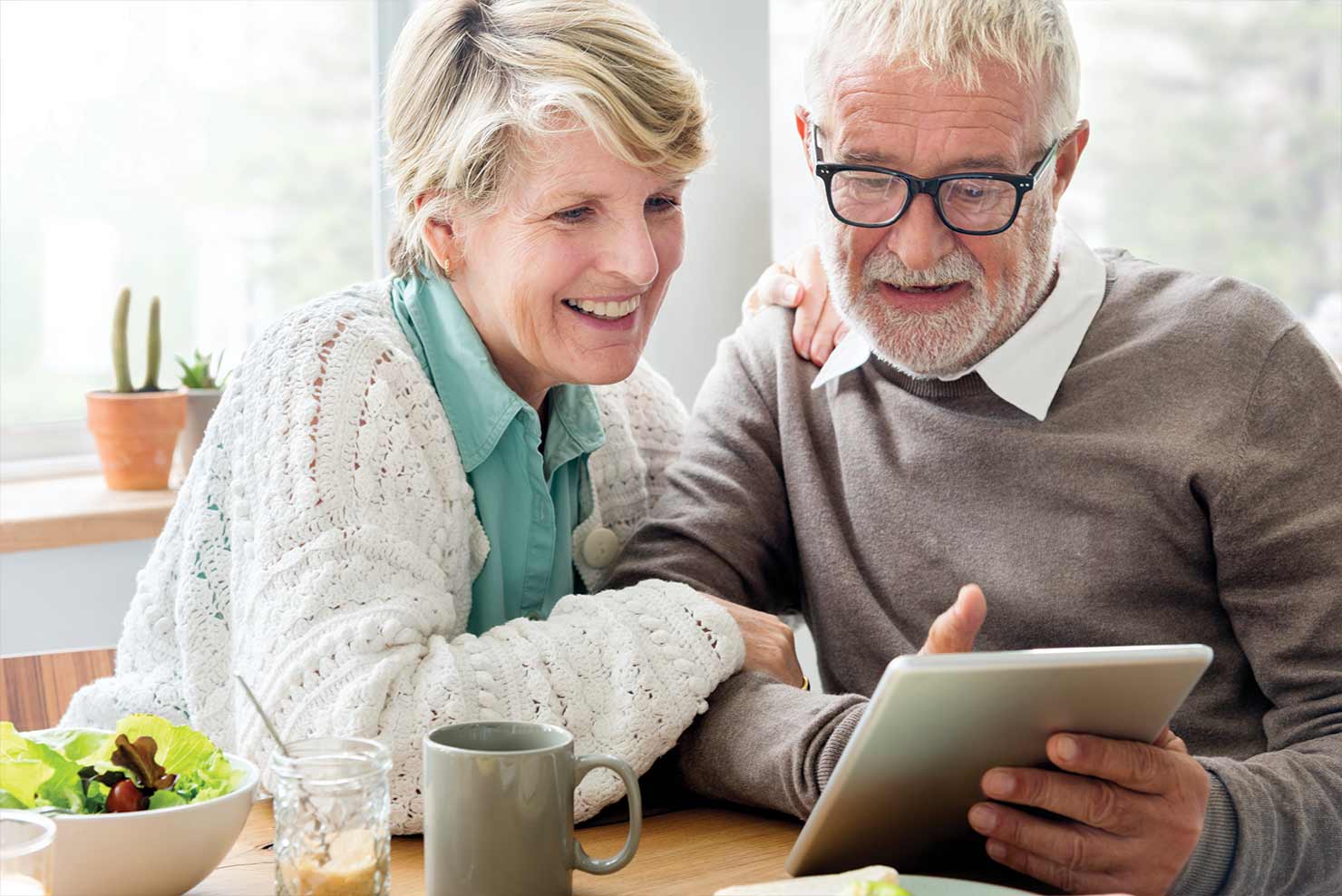

Purchasing a tax-deferred annuity is a good way to ensure a steady income stream during retirement.

Tax-Deferral Benefits

Tax-deferred annuities offer the advantage of retirement income growth until you withdraw money. Capital gains, dividends, and interest can also be fully reinvested in the annuity. This will allow your income to grow without having its value reduced by taxes.

With a tax-deferred annuity, retirees can also maximize the benefits of other retirement strategies. For instance, if your income exceeds a certain level, your social security benefits may be reduced. Thus, you must report interest you earn from CDs, bonds, or other investments to the IRS. An annuity, however, does not count your earnings against you. Taxes are due once money is taken out.

Taxes on Retirement Income Withdrawals

There may be tax benefits available if you purchase a fixed index annuity with after-tax dollars. Two main elements make up an FIA – the accumulation phase and the distribution phase. A tax advantage is available to your FIA during the accumulation or growth phase. Taxes are only due when you withdraw money. Generally, you are taxed only on ordinary income, not on capital gains, when you withdraw income from a fixed index annuity. With a lower liability, you may be able to earn more in retirement. Contact us to review your options for taxes on retirement income.

Deferred Annuities vs. IRAs, and 401(k)s

Fixed index annuities, however, offer more flexibility and fewer restrictions, than IRAs and 401(k)s.

- There is no limit on the number of contributions to an FIA.

- It is also possible to roll over a 401(k) or IRA into an index annuity in many cases.

- The money you earn compounds tax-free year after year.

- Contributing tax-free means keeping every penny you earn.

Early Retirement and Tax-Deferred Annuities

The eligibility for early retirement benefits is based on several factors.

- You must be under the age of 59 1/2

- Need to have a 401(k) plan providing lump-sum payments

- You need to have received a lump sum payment as part of a severance package or a retirement package

If you can satisfy all three requirements, you may qualify. It might be possible for you to roll over your money into an annuity policy without paying taxes.

Our team at Hybrid Financial can help you determine how to handle taxes on retirement income suitable for you.